how to short a stock td

Rejected-no shares available to borrow. Short selling is a speculative trading strategy normally done in anticipation of falling prices.

Learn How To Place Trades And Check Orders On Tdameri Ticker Tape

Shorting is done by borrowing stock so the broker.

. It is illegal for a seller not to declare a short sale at the time an. Stock prices can be volatile and you cannot always repurchase shares at a lower price whenever you want. My friends with other platforms never run into this issue.

In order to use a short-selling strategy you have to go through a step-by-step process. Selling a security you do not own. Ad In-Depth Training and Support to Help You Succeed in Your Learning Objectives.

Once on the Accounts Details page select the TD Direct Investing CAD or USD Margin Short account you want to trade in and follow the steps. 5 SNOW stocks 10 NVDA stocks 3 CAT stocks short 10 NFLX stocks. Shorting a stock or short selling a stock may be considered when one thinks the price of a stock will go down.

These are the six steps to sell a stock short. TD Ameritrades desktop platform can be used to establish short positions on any of the products discussed above. The uptick rule is another restriction to short selling.

Your broker locates the shares for you and you receive 5000 in your. In the Enter Symbol space in the chart section you want to add the stocks you want to chart using the following formula. The equity required to maintain your short position may vary based on the market price of the security you shorted and if the short position moves against you your account could face a margin call requiring you to deposit additional funds.

Visit The Official Edward Jones Site. Thus your potential gain in. Do Your Investments Align with Your Goals.

In WebBroker go to the Accounts tab and under Account Details select Holdings. Note that you will need a margin account to short stocks. Shorting stock involves selling batches of stock to make a profit then buying it back cheaply when the price goes down.

For a stock to be sold short it has to be marginable which means it has to trade over 500. Naked short selling is the shorting of stocks that you do not own. Enter your short order for the appropriate.

Open a TD Ameritrade Account. Select the ticker symbol of the stock you want to bet against. Then fund your account with at least 2000 which is a requirement for.

2 Traders should know these types of limitations could impact their strategy. You can check a box to buy sell or short a. Make sure that you have a margin account with your broker and the necessary permissions to open a short position in a.

First youll need a margin account. The broker therefore cant borrow the stock for you to sell short because it isnt held in their clients margin accounts. Stock brokerage order tickets are fairly uniform.

Identify the stock that you want to sell short. Ad Smart Options Strategies shows how to safely trade options on a shoestring budget. Enable the account for short selling.

With short selling its about leverage. During our testing we found the simplest method to establish a short position was to right-click on a chart and select sell from the drop-down menu. Borrowing shares from the brokerage is effectively a margin loan and youll pay.

A fundamental problem with short selling is the potential for unlimited losses. If there are shares available to short your order will be filled. To add marginoptions to an account a New Account Application Form NAAF must be completed and submitted to TD Direct Investing with the change-to section ticked and with all applicable signatures.

Put in a sell order for a stock you have no shares of. You will apply for margin trading sign documents acknowledging the risks. Download Smart Options Strategies free today to see how to safely trade options.

Ive tried it with all sorts of stocks including many popular stocks that have huge volume and many of which arent even moving down. When selling the security at a certain price and then buying it back Buy to Cover the profit or loss would be the difference between the initial selling price and the subsequent purchase price. Ive tried to short a multitude of different stocks over the past few days and I get the message.

New Look At Your Financial Strategy. How to short stock w Td Ameritrade 3 minFacebook. How To Short A Stock On TD Ameritrade Step 1.

Short stock trades occur because sellers believe a stocks price is headed downward. Enter a regular sell order to initiate the short position and your broker will locate the shares to borrow automatically. I think the problem is the stock price.

You decide to short 100 shares of the stock at 50 a piece. Direct Your Broker to Execute a Short Sale on a Specific Stock. Investors sell stocks theyve borrowed from a lender on the expectation the price will drop allowing them to rebuy and replace the stocks they borrowed at a lower price.

Find a Dedicated Financial Advisor Now. If you apply and qualify you can trade using a short account in WebBroker Advanced Dashboard and the TD app. This rule is designed to stop short selling from further driving down the price of a stock that has dropped more than 10 in one trading day.

You can get a list of the most shorted stocks based on the percentage of shares outstanding from the NYSE and Nasdaq by clicking on the Screeners tab on the homepage and going to. A Simple Example of Shorting a Stock. When you buy a stock go long you can never lose more than your invested capital.

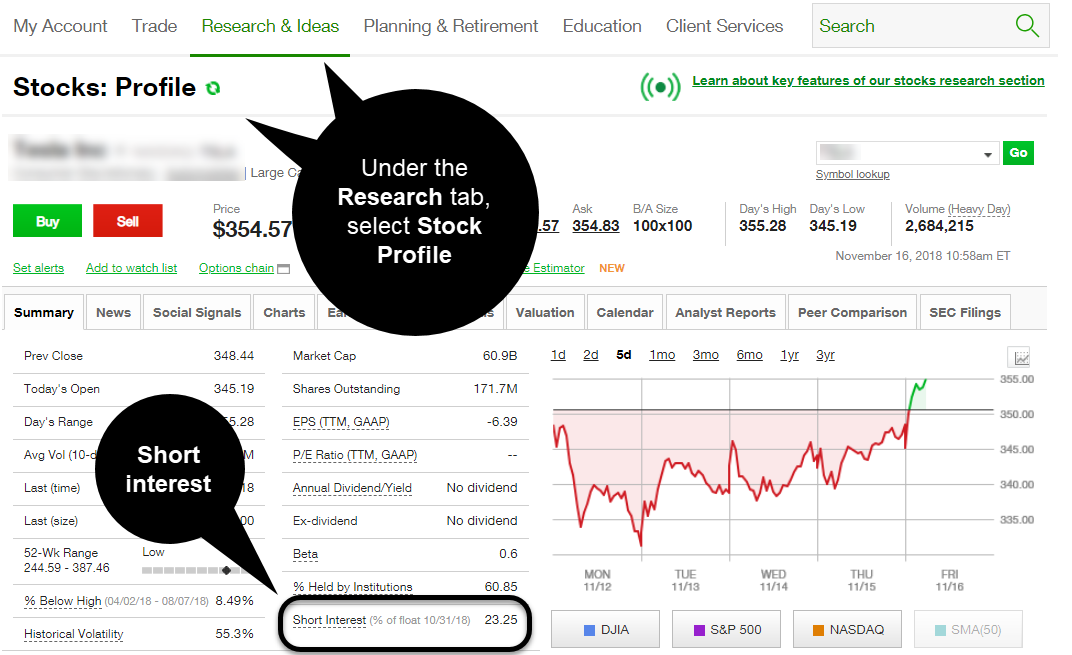

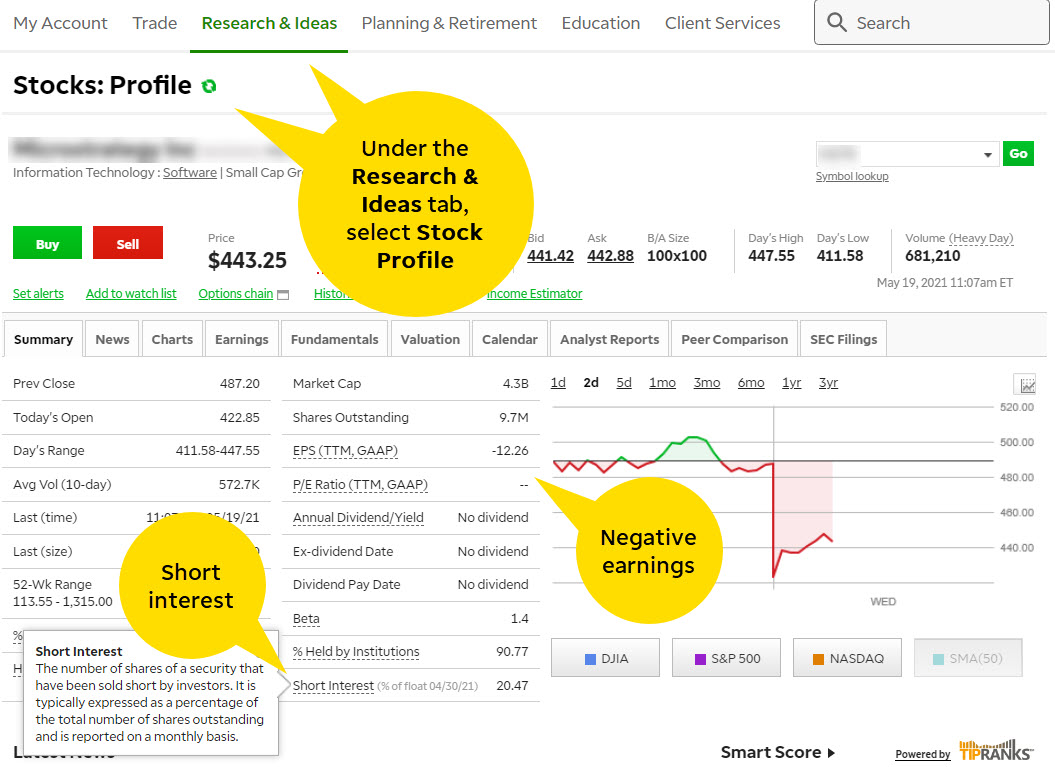

A bit of poking around brought me to this thread on the Motley Fool asking the same basic question. In order to short sell on TD Ameritrade you must have a margin-enabled non-retirement account with at least 2000 in marginable equity. How to short a stock.

You want to chart the following stocks. A trader who intends to short a stock should maintain a funded margin account with their broker since margin is needed for shorting a stock. Log into your brokerage account or trading software.

To add short selling to an existing margin account please Contact us for details. Forms can be obtained through our TD Direct Investing website or in person at any TD. Lets say you are a seasoned trader and youre confident that stock XYZ is overvalued in the market and will likely experience a price drop in the next couple of weeks.

Answer 1 of 3.

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2022

Most Popular January Stocks Value Investing Investing Finance

Good Eye Trader How To Pick The Right Stocks At The Ticker Tape

How To Short Sell A Stock Td Ameritrade Think Or Swim Youtube

Learn How To Place Trades And Check Orders On Tdameri Ticker Tape

Bulls And Bears Might Not Always Get Along But They Can Each Make Money Stocks Stockmarketcrash Stockmar Stock Trading Stock Market Training Swing Trading

Td Ameritrade Shorting Stocks How To Short Sell 2022

Short Selling Stocks Td Direct Investing

The Short And Long Of It Your Top Questions On Short Ticker Tape

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2022

How To Swing Trade Penny Stocks Penny Stocks Swing Trading Stock Chart Patterns

Playing Opposites Why And How Some Pros Go Short On Ticker Tape

Shorting A Stock Seeking The Upside Of Downside Markets Ticker Tape

Village Farms International Stock Analysis Overview Stock Analysis Stocks To Watch Analysis

Shorting A Stock Seeking The Upside Of Downside Markets Ticker Tape